Money

Mapped: The Risk of Eviction and Foreclosure in U.S. States

Mapping the Risk of Eviction and Foreclosure in U.S. States

Alongside potential obstacles such as job loss, financial insecurity, and a subsequent inability to cover many upcoming bills, many Americans are now facing potential home loss as well.

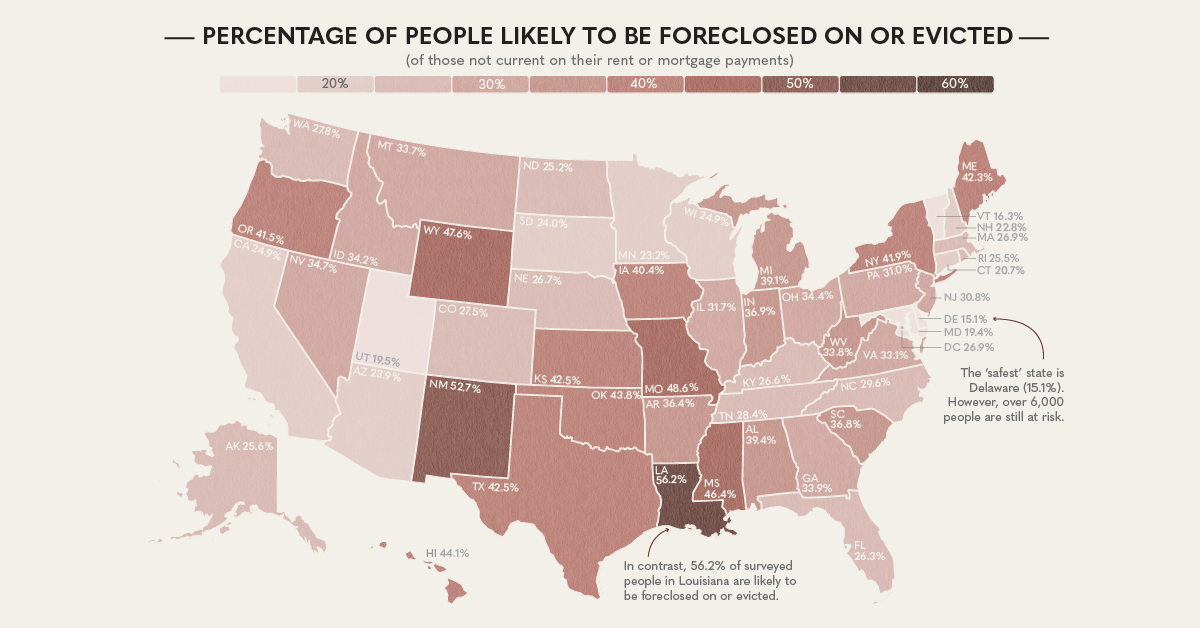

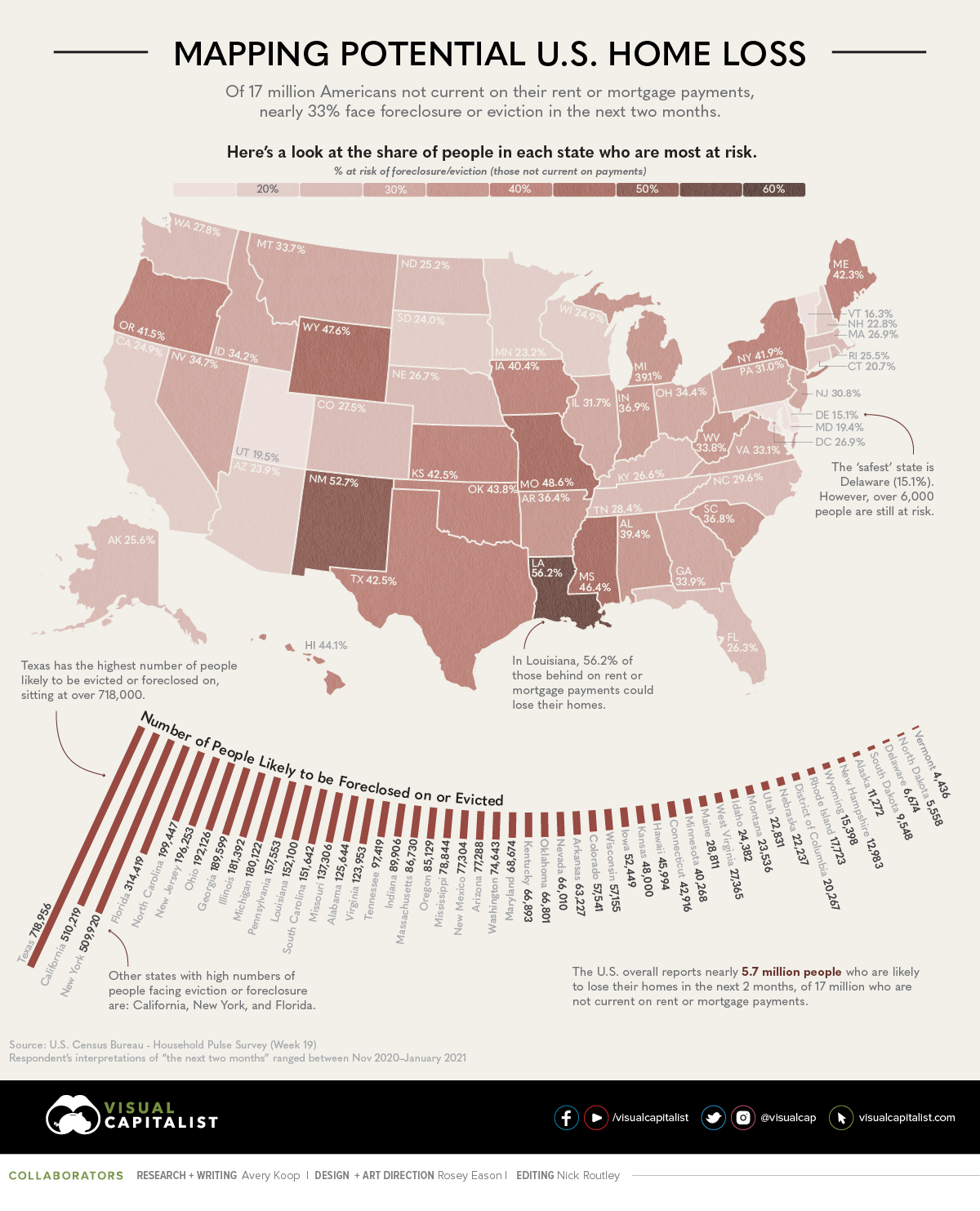

According to a recent survey by the U.S. Census Bureau, of the estimated 17 million adults who are not current on their rent or mortgage payments, a whopping 33% of them could be facing eviction or foreclosure in the “next two months”.

Note: While this survey was conducted Nov 11-23, 2020, respondents’ interpretations of “the next two months” ranged between Nov 2020–Jan 2021.

Millions Facing Home Loss

Although people across the country face similar risks, Texas stands out with an estimated 718,000 people facing foreclosures or eviction. In fact, more than 7.1 million people in the state may be expecting a loss of employment income in the coming four weeks.

Other states looking at high percentages of potential home loss include Louisiana, New Mexico, Mississippi, Wyoming, and Missouri.

To get a closer look, here are the top 10 metro areas with the highest percentages of people who will potentially be facing eviction or foreclosure:

| Rank | Area | Number | Percent |

|---|---|---|---|

| 1 | Houston-The Woodlands-Sugar Land, TX Metro Area | 265,454 | 47.6% |

| 2 | Miami-Fort Lauderdale-Pompano Beach, FL Metro Area | 147,830 | 34.1% |

| 3 | Atlanta-Sandy Springs-Alpharetta, GA Metro Area | 96,514 | 33.8% |

| 4 | Chicago-Naperville-Elgin, IL-IN-WI Metro Area | 184,381 | 33.3% |

| 5 | Dallas-Fort Worth-Arlington, TX Metro Area | 157,986 | 32.8% |

| 6 | Seattle-Tacoma-Bellevue, WA Metro Area | 52,959 | 32.5% |

| 7 | Detroit-Warren-Dearborn, MI Metro Area | 75,379 | 32.3% |

| 8 | New York-Newark-Jersey City, NY-NJ-PA Metro Area | 389,352 | 32.0% |

| 9 | San Francisco-Oakland-Berkeley, CA Metro Area | 61,647 | 31.1% |

| 10 | Phoenix-Mesa-Chandler, AZ Metro Area | 67,287 | 30.0% |

Note: The margin of error of the survey is higher in metro areas and smaller states.

Home for the Holidays?

On the other end of the spectrum, there are states that appear to have less need for concern, as the percentage of people likely to experience foreclosure or eviction in these places stands between 15% and 20%. However, this level of relative home security is the case for only Delaware, Vermont, Maryland, and Utah.

Everyone else is floating in a proverbial gray area, between a majority who may still be in their same home after Christmas, and those who may need to find a new place in the months following the holidays.

Even in the states with extremely low percentages like Delaware (15%), there are still thousands people who are highly likely to face the possibility of losing their home.

Going Forward

It goes without saying that with nearly 17 million Americans behind on mortgage and rent payments, there could be significant consequences down the road.

In an order issued by the CDC under the Public Health Service Act, it was stated that an eviction moratorium could help with the effectiveness of COVID-19 prevention measures like quarantining, social distancing, and self-isolation. However, while evictions were temporarily halted under this order on September 4th, the extent of this protection runs out on the last day of 2020.

President-elect Joe Biden expressed his desire for measures such as rent forgiveness back in March 2020, but it remains unclear what actions will be taken under the new administration when inauguration occurs on January 20th, 2021.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Culture6 days ago

Culture6 days agoThe World’s Top Media Franchises by All-Time Revenue

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands2 weeks ago

Brands2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

Economy2 weeks ago

Economy2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money1 week ago

Money1 week agoCharted: Who Has Savings in This Economy?